401k to roth ira tax calculator

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free.

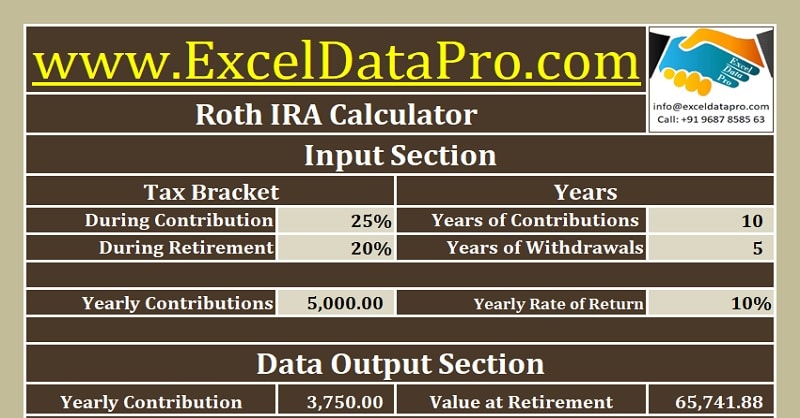

Download Roth Ira Calculator Excel Template Exceldatapro

Roth IRAs have a lot of benefits like tax-free withdrawals in retirement.

. 401k Withdrawing money from a 401k early comes with a 10 penalty. 529 State Tax Calculator Answer a few simple questions to see whether your state offers a tax benefit for 529 plan contributions and if so how much it might be. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from. As soon as those 60 days are up the money from the IRA is considered to be cashed out. 1 With Fidelity you have a broad range of investment options including.

Consider all the factors to find out whether youd be better off in another states plan. Heres more on the pros and cons of the IRA vs. If you return the cash to your IRA within 3 years you will not owe the tax payment.

Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required. Required minimum distributions RMDs Most owners of traditional IRAs and employer-sponsored retirement plan accounts like 401ks and 403bs must withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020. Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k.

A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. With a Roth IRA you contribute after-tax dollars your money grows tax-free and you can generally make tax- and penalty-free withdrawals after age 59½.

401k traditional IRA or Roth IRA. And they dont force you to take mandatory withdrawals from your retirement savings later in life like 401ks do. 401K and other retirement plans.

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. With a Traditional IRA you contribute pre- or after-tax dollars your money grows tax-deferred and.

Keep in mind you can open a 529 plan from any stateno matter which state you live in. Additionally you dont have to pay taxes when you make qualified withdrawals.

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Ira Calculators

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most